This Motley Fool Stock Advisor Review is based on my personal experience of being a subscriber to the Motley Fool Stock Advisor service AND buying about $2,000 of EACH of their stock picks since 2016 in my ETrade account.

I try to update this review every month so you can see how these Motley Fool stocks have performed since inception in 2002, as well as how they have performed recently for me over the last 6 years.

If you invest in individual stocks, you probably know The Motley Fool. They offer many free product reviews. At the bottom of each article is a card for a premium financial advisory service.

When you sign up, you will receive two new stocks every month and the “Top 10 Startup Stocks” list. But is a product advisor useful?

What is the Motley Fool?

The Motley Fool is an investing and financial information service founded by the Gardner brothers in Alexandria, Virginia. Its site, Fool.com, offers a number of free articles in areas such as:

- Investing basics

- Stock market

- Retirement

- Personal Finance

Besides the main Motley Fool site, The Ascent “provides personal finance product reviews related to credit cards, banking, brokerage firms, mortgages, and personal loans.”

Millionaires is another site launched by The Motley Fool. This site focuses on real estate investment and provides insights into various aspects and types of real estate investing.

| Product Name | Motley Fool |

| Services | Premium Stock-Picking Newsletters |

| Newsletter Types | StockAdvisor: Starter StocksRule Breakers: High-Growth StocksRule Your Retirement: Index funds and ETFsDiscovery: Cloud Disruptors: Cloud Computing Stocks |

| Membership Fee | $89 to $1,999 per year |

| Promotions | 30-Day Money-Back Guarantee |

Motley Fool Stock Advisor Review: Market-Beating Returns

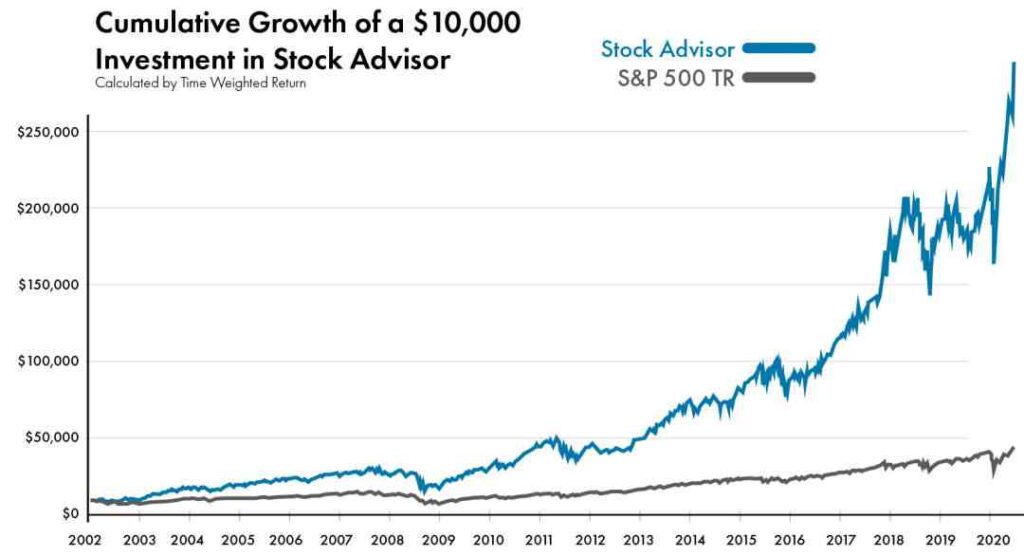

Stock Advisor has 3X’ed the S&P 500 over the last 20 years: The Stock Advisor team has outperformed the market 3-to-1 by rigorously combing every corner of every industry for overlooked companies we believe could be poised to shatter the market – often when these businesses are flying under Wall Street’s radar.

How many Stock Advisor Stocks should you own?

Stock Advisor guides you to own around 15 individual stocks. Of course, you can gradually build up to that amount by investing in new companies as your portfolio size grows.

For each stock position you buy, The Motley Fool recommends that one position consume no more than 5% of your total portfolio. By following this rule, you invest $500 in each stock for every $10,000 in your portfolio.

Unless you do fractional share investing with M1 Finance, you probably won’t have enough free cash to invest in every single idea.

So, don’t feel bad if you don’t invest in something new each month. In some cases, the brothers might re-recommend a previous stock. This can happen if the fundamentals improve.

When you get two new pt to have to invest in both or either of them, one reason why is that you icks, you don’don’t agree with the business model of each business. Sometimes, you might not understand how the company makes money long-term.

For example, I’m not going to invest in the active recommendation for Tesla. When it comes to this polarizing company, I’m in the bear camp.

Types of Stocks

Stock Advisor usually picks growth stocks and blue chip stocks with high potential for long-term returns. This means you might see a variety of different companies and industries and different justifications for each stock pick.

Stock prices vary, but don’t expect to see penny stocks or stocks with low purchase prices. If you want to sort by price or something else, use the Stock Screener on the Motley Fool website to browse through the various stocks you get from the Motley Fool service or check out other stocks.

What to look for in the Motley Fool

Subscribers should look for the two big stock recommendations from Tom and David each month.

Also, the brothers share their recommended “Best Buys” that could help fill out your portfolio. New recommendations come out every Thursday.

Motley Fool’s Performance Track Record

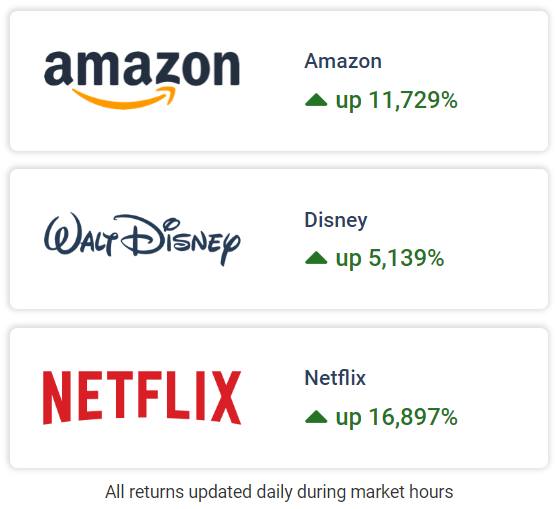

The Motley Fool Stock Advisor claims a performance track record of 421% profit since 2002 versus the S&P 500 increase of 85%. This track record is impressive but is it true? We put it to the test.

Motley Fool does not try to perform analysis on every stock and fund in the USA. The team focuses on specific stocks that they feel will, over the long term, significantly beat the S&P 500.

They then provide lightweight and easy-to-read research reports and suggest why they feel the stock will be a superior long-term investment.

Motley Fool Stock Advisor Portfolio Performance 2002 to 2020

| Motley Fool Stock Advisor | S&P 500 |

|---|---|

| 421% | 85% |

The team at Motley Fool claims outstanding market-beating performance.

But is this true? In the next section, I perform an independent analysis to verify the facts.

You can get the Motley Fool Advisor for Free

There is no way to get the Motley Fool’s stock advisor for 100% free (unless you have a special inside link). However, you can try Motley Fool for free for 30 days.

You will need to cancel your trial subscription within a month to avoid paying $99 for the first year. This may be enough to determine if the product advisor is useful.

An indirect way to get the Motley Fool premium service for free is to search for exclusive emails. You can buy a multi-year subscription after that, which will give you free years in the future.

This estimate is based on the latest Motley Fool market estimates. Personally, I haven’t seen this for Market Advisor yet, but I recently caught a deal that gives violators two years for the price of one year.

Motley Fool Stock Advisor Review: Pros & Cons

Pros

- Premium Investment Research

- Multiple Targeted Products

- Low Prices (Especially with Promotions)

- Transparency

Cons

- Newer Products Lack Track Records

Motley Fool Features

| Service | Premium Stock-Picking Newsletters |

| Sisters Companies and Services | The AscentMotley Fool Wealth ManagementSoapboxMFAM FundsMotley Fool VenturesThe BlueprintMillionacres. |

| Newsletter Types | StockAdvisor: Starter StocksRule Breakers: High-Growth StocksRule Your Retirement: Index funds and ETFsDiscovery: Cloud Disruptors: Cloud Computing Stocks |

| Membership Fee | $89 to $1,999 per year |

| Wealth Management Pricing | Index funds portfolios: 0.40%Stock portfolios: 0.95% (for stock portfolios) For accounts less than $1 million range |

| Customer Service Phone Number | (877) 629-2589 |

| Customer Service Hours | Mon-Fri, 9 AM to 5 PM (ET) |

| Customer Service Email | [email protected] |

| Mobile App Availability | None |

| Promotions | 30-Day Money-Back Guarantee |

* Based on the $199/year list price. Introductory promotion for new members only.

Motley Fool Stock Advisor Review: FAQs

Here are some common questions that we get about the Motley Fool.

Q: How do The Motley Fool newsletters work?

Each month, you’ll gain curated stock picks based on researcher suggestions. In addition to the monthly picks, you’ll get a list of ten stocks you should buy today based on an analysis of 300 stocks. You’ll also receive a list of recommended “starter stocks” to add to your portfolio.

Members gain access to educational materials and timely resources to help them improve their investment strategies. Although it provides many resources, this service does not include assistance with investing, so you’ll need to do that yourself.

Q: What is the Motley Fool Stock Advisor’s performance record?

Since launching 20 years ago, Stock Advisor has had 157 Stock Recommendations with 100%+ Returns. With the average stock returning 352% as of October 2022, they’ve performed three times better than the S&P (The company updates this number regularly).

Q: How much does Stock Advisor cost?

Stock Advisor has an annual fee of $99 (approximately $1.90 per week). Also, it offers a one-month subscription option. It costs $39.

Q: How do you cancel Motley Fool subscriptions?

You can cancel most Motley Fool subscriptions in your “My Account” section by selecting “turn off auto-renewal”. You can also contact their customer service to cancel.

Q: Is Motley Fool Stock Advisor legit?

Yes. Founded in 1993, the Motley Fool offers personal finance and investing recommendations as a limited liability company (LLC). The platform took its investment guidance a bit further by launching Stock Advisor in 2002.

Q: Is Motley Fool Good?

Yes. The Motley Fool has proven that the picked stocks perform by far better than the market average. The stock picking services are affordable, and each stock pick comes with a detailed explanation about why the stock has been chosen.

Q: Is Motley Fool a scam?

Not in the least. When you have such high returns, it looks like the Motley Fool is too good to be true. However, it is a legitimate company with over 700,000 subscribers and 250+ employees.

Motley Fool Stock Advisor Review: Conclusion

Overall, Motley Fool Stock Advisor is an excellent product at a reasonable price for the value it offers. If you’re ready to purchase individual stocks, want help picking them, and you’re willing to pay for expert recommendations, this is a really solid choice with a performance that speaks for itself.

In addition to 24 stock picks per year, you’ll receive valuable tools and resources to help inform the rest of your long-term, passive investing.

However, Stock Advisor has limitations. You can’t customize the type of recommendations you receive and you will get the same information as everyone else who has a subscription. If you’re looking for more personalization and help to build a portfolio from scratch, consider an alternative like a Robo-advisor.

If you do sign up, come back to our Motley Fool Stock Advisor review for tips to make the most of your subscription.

More on Moneyintra

- Rivian Stock Price Prediction 2023, 2025, 2030, 2040 and 2050

- What is OnlyFans Stock and How can you Invest?

Subscribe to our Channel on Telegram